Getting My Eb5 Investment Immigration To Work

Getting My Eb5 Investment Immigration To Work

Blog Article

5 Easy Facts About Eb5 Investment Immigration Explained

Table of ContentsGetting My Eb5 Investment Immigration To WorkLittle Known Questions About Eb5 Investment Immigration.How Eb5 Investment Immigration can Save You Time, Stress, and Money.The Only Guide to Eb5 Investment ImmigrationFascination About Eb5 Investment Immigration

Contiguity is developed if demographics systems share borders. To the extent possible, the consolidated census systems for TEAs must be within one city area without greater than 20 demographics systems in a TEA. The consolidated census systems must be an uniform shape and the address should be centrally situated.For more information about the program see the U.S. Citizenship and Immigration Services web site. Please allow 30 days to refine your demand. We usually respond within 5-10 service days of receiving accreditation demands.

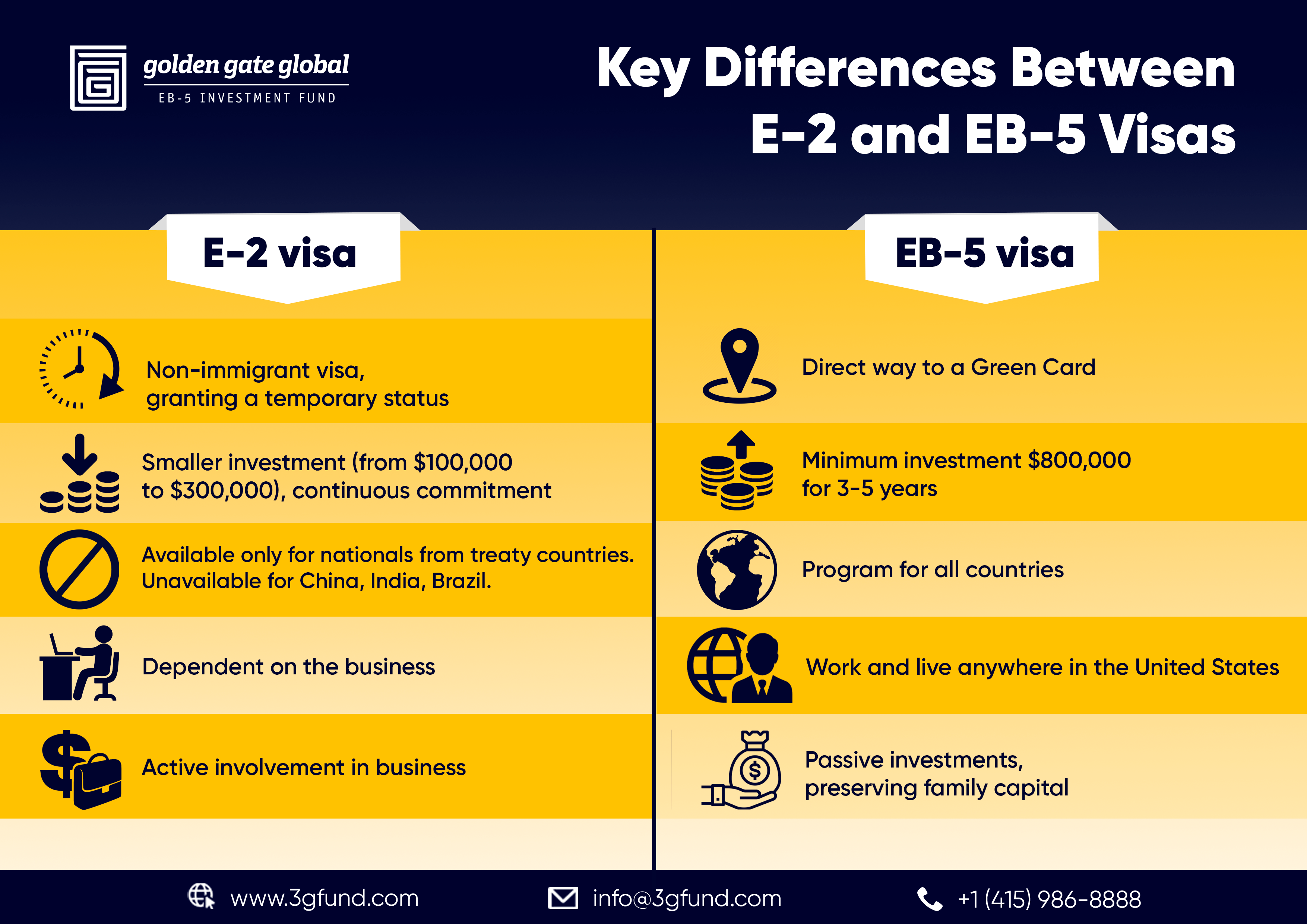

The U.S. federal government has taken steps intended at boosting the degree of international investment for nearly a century. This program was broadened via the Migration and Nationality Act (INA) of 1952, which produced the E-2 treaty investor course to additional draw in international financial investment.

employees within two years of the immigrant capitalist's admission to the USA (or in certain situations, within a practical time after the two-year duration). Furthermore, USCIS may attribute capitalists with protecting jobs in a troubled organization, which is defined as a business that has actually been in existence for at least 2 years and has actually endured a bottom line throughout either the previous 12 months or 24 months prior to the priority day on the immigrant financier's first petition.

Fascination About Eb5 Investment Immigration

The program maintains rigorous capital requirements, requiring candidates to show a minimal certifying financial investment of $1 million, or $500,000 if bought "Targeted Work Areas" (TEA), which consist of certain designated high-unemployment or backwoods. Most of the authorized regional centers establish investment chances that are located in TEAs, which qualifies their foreign capitalists for the reduced financial investment threshold.

To get approved for an EB-5 visa, a capitalist must: Invest or remain in the process of investing at least $1.05 million in a new business in the USA or Spend or remain in the process of investing at the very least $800,000 in a Targeted Employment Location. EB5 Investment Immigration. (On March 15, 2022, these amounts raised; prior to that date, the united state

Extra specifically, it's a location that's experiencing at the very least 150 percent of the nationwide typical rate of joblessness. There are some exemptions to the $1.05 million company investment. One approach is by establishing the financial investment company in a financially tested location. For instance, you might contribute a minimal business financial investment of $800,000 in a backwoods with much less than 20,000 in population.

The Single Strategy To Use For Eb5 Investment Immigration

Regional Facility investments allow for the consideration of economic effect on the neighborhood economic climate in the type of indirect employment. Any investor thinking about spending with a Regional Facility need to be very mindful to take into consideration the experience and success price of the business prior to spending.

The investor first needs to file an I-526 request with U.S. Citizenship and Migration Services (USCIS). This application should consist of evidence that the investment will create full time employment for at the very least 10 U.S. people, long-term citizens, or other immigrants that are accredited to function in the United States. After USCIS authorizes the I-526 application, the investor might obtain an environment-friendly card.

Everything about Eb5 Investment Immigration

If the investor is outside the United redirected here States, they will need to go with consular processing. Investor environment-friendly cards come with conditions attached.

Yes, in specific circumstances. The EB-5 Reform and Stability Act of 2022 (RIA) included area 203(b)( 5 )(M) to the INA. The brand-new area typically permits good-faith investors to find out preserve their qualification after termination of their local center or debarment of their NCE or JCE. After we inform financiers of the termination or debarment, they might keep eligibility either by alerting us that they continue to satisfy qualification requirements notwithstanding the termination or debarment, or by changing their application to reveal that they satisfy the demands under area 203(b)( 5 )(M)(ii) of the INA (which has different requirements relying on whether the financier is seeking to retain eligibility because their regional center was terminated or since their NCE or JCE was debarred).

In all situations, we will make such resolutions constant with USCIS policy regarding deference to prior resolutions to make certain constant adjudication. After we terminate a regional facility's designation, we will withdraw any kind of Type I-956F, Application for Authorization of a Financial Investment in a Company, connected with the ended local facility if the Form I-956F was approved as of the date on the local center's discontinuation notification.

Some Known Facts About Eb5 Investment Immigration.

Report this page